Loan-to-Value Ratio – How It Affects Your Loan

If you're buying your first home, you've probably heard of LVR—but what does it mean, and why do lenders care so much about it?

This guide breaks down the essentials so you can feel more confident and in control of your home loan journey.

What Is Loan-To-Value Ratio (LVR)?

The Loan-to-Value Ratio (LVR) is a financial term that compares the amount of the loan with the value of the property being purchased, expressed as a percentage.

Put simply, LVR is the percentage of the property value you’re borrowing. It tells lenders how much risk they’re taking by giving you a loan.

Watch this quick explainer on LVR:

In this short video, we break down how LVR works and what it means for your home loan journey.

Why is LVR Important?

Lenders use LVR to assess the risk associated with your loan:

Lower LVR (≤80%): Indicates a lower risk to lenders. Borrowers with a lower LVR are more likely to secure loan approval and may benefit from more favorable interest rates. Additionally, an LVR of 80% or less typically means you won't need to pay LMI.

Higher LVR (>80%): Represents a higher risk to lenders. In such cases, lenders usually require borrowers to pay LMI to protect themselves against potential default.

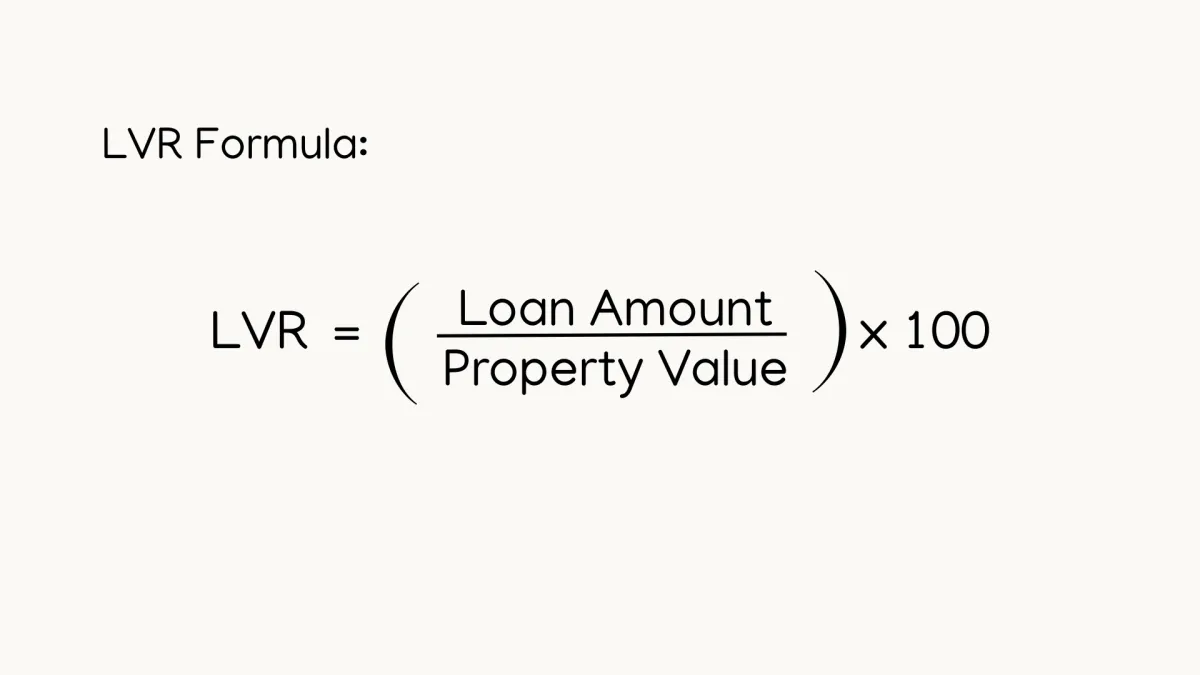

How Is LVR Calculated?

Loan-to-Value Ratio (LVR) is calculated by dividing the amount you intend to borrow by the property's appraised value, then multiplying the result by 100 to get a percentage. This figure helps lenders assess the risk of your home loan application.

Example:

If you’re borrowing $400,000 for a home worth $500,000:

So you're borrowing 80% of the property’s value. Simple, right?

How Does LVR Affect Home Loan Approval

Your Loan-to-Value Ratio (LVR) plays a major role in the outcome of your home loan application. Understanding how LVR works can help you make smarter borrowing decisions.

Interest Rates

Lenders often use tiered interest rates based on LVR brackets.

Borrowers with an LVR below 60% are usually offered the most competitive rates

An LVR between 60% and 80% may attract moderately higher rates.

If your LVR exceeds 80%, expect even higher interest rates due to the increased lending risk.

Loan Approval

Your LVR is a major factor in determining your loan eligibility.

Lenders typically have a maximum LVR threshold, and exceeding it could reduce your borrowing power.

In some cases, a high LVR may result in loan rejection.

Lenders Mortgage Insurance (LMI)

When your LVR is over 80%, most lenders will require you to pay Lenders Mortgage Insurance.

While LMI protects the lender if you default, it’s an additional upfront cost for the borrower—potentially adding thousands to your loan expenses.

Learn more about LMI here

What’s Considered a “Good” LVR For A Home Loan?

For most standard residential properties, banks typically prefer an LVR of 80% or below. Here’s why that matters:

LVR ≤ 80%: You’re in the safe zone! You're less likely to need Lenders Mortgage Insurance (LMI), and you may get a better interest rate.

LVR > 80%: You’re borrowing more than 80% of the property’s value. This is still possible, but you’ll either need to:

Qualify for a government scheme, or

Be prepared to pay LMI, which protects the lender—not you.

Take note: Having a low LVR means low risk for lenders.

Why Is a High LVR Risky?

A high Loan-to-Value Ratio (LVR) poses significant risks for both lenders and borrowers. For lenders, a high LVR increases the potential for financial loss if the borrower defaults, as the property may not be worth enough to cover the outstanding loan amount.

For borrowers, a high LVR can create several financial challenges:

Lenders Mortgage Insurance (LMI): If your LVR exceeds 80%, most lenders will require you to pay LMI. This one-time premium protects the lender, not you, in case you can’t repay the loan.

Stricter Lending Criteria: Loans with high LVRs often come with tighter approval requirements and reduced borrowing flexibility.

Higher Interest Rates: To compensate for the increased risk, lenders may apply a higher interest rate—leading to higher repayments over the life of your loan.

Limited Loan Features: Access to beneficial features like offset accounts, redraw facilities, and split loans may be restricted for high LVR borrowers.

Negative Equity Risk: A higher loan amount means lower initial equity. If property prices drop, you could end up owing more than your home is worth—a situation known as negative equity.

Smart Ways to Lower Your LVR

Want to avoid the extra costs and risks of a high LVR? Here are four practical strategies to reduce your loan-to-value ratio:

Increase Your Deposit

Saving a larger deposit is the most effective way to lower your LVR. Aim for at least a 20% deposit to avoid paying LMI altogether.

Use a Family Guarantee

A family member can offer their property as security, allowing you to borrow up to 100% without paying LMI.

Explore First Home Buyer Schemes

Government programs like the First Home Guarantee can help eligible buyers avoid LMI by offering a guarantee on part of the loan.

Check for LMI Waivers by Profession

Certain professions, such as medical professionals, lawyers, and accountants, may be eligible for waived LMI under specific lender policies.

Consider a More Affordable Property

Looking for a lower-priced home can significantly improve your loan position. With a smaller purchase price, your existing deposit goes further, reducing your Loan-to-Value Ratio (LVR) without needing to save more.

Common Mistakes and Misconceptions About LVR

Understanding your Loan-to-Value Ratio (LVR) is key to making smart home loan decisions. But many borrowers make avoidable mistakes that can lead to higher costs or financial stress. Here are some common LVR pitfalls to watch out for:

Believing All Lenders Have the Same Rules

LVR limits, interest rates, and Lenders Mortgage Insurance (LMI) requirements differ between lenders. Always compare your options to get the best deal.

Overlooking Upfront Costs

Focusing only on your LVR or deposit isn’t enough. Don’t forget additional expenses like stamp duty, legal fees, and inspections—they can impact your borrowing power and budget.

Thinking LMI Protects You

LMI doesn’t protect you—it protects the lender if you can’t repay your loan. You’re still responsible for the full debt even with LMI in place.

Not Exploring Ways to Lower LVR

You may not need a bigger deposit to reduce your LVR. Consider guarantor loans or government first-home buyer schemes to avoid paying LMI and improve your borrowing position.

The Bottom Line

Your Loan-to-Value Ratio (LVR) is more than just a number—it can affect everything from your loan approval to your interest rate and whether you’ll have to pay thousands in Lenders Mortgage Insurance (LMI). Remember, Lower LVR = lower risk = better interest rates

Whether you're a first-time buyer or just brushing up on home loan basics, keeping your LVR in check puts you in a stronger position with lenders—and can lead to serious savings.

Want to Keep Learning?

Lender’s Mortgage Insurance (LMI)

What It Means for You

Stamp Duty

What Is It & How Much Will You Pay?

Saving for a Deposit

How Much Do You Really Need?

FOLLOW US

© 2025 Estate Seeker.ai - All Rights Reserved. Content on this site is for educational purposes only.

Always consult with a professional before making any investment decisions.